In most of the cases, the savings of a person are never enough. Problems never knock your door before coming to you; they just enter like a thief and just take all your serenity. Your finances might get exhausted and you may need help from your family or friends, but only if it is a small amount; for huge sum of money you should consider getting some help from the banks or any other lending institution. If you possess an asset, you can get a loan against your property.

To get a loan against property you could consider keeping your home as collateral with the bank. Then the bank would send its assessing agents or take help from the agents provided by the government to assess the value of the house after which it may offer you’re a bank loan of up to 60% to 70% of the property’s current market price. Loan against property is a secured loan which will fetch you a higher amount on credit than that of a personal loan that if of course an unsecured loan. The administrative and the processing fee that is levied by the banks also have to be paid, which is generally 0.5% to 1.5% of the borrowing amount. Mostly the length of the loan tenure is up to 9 years, but a few banks might stretch it up to a maximum of 15 years. The banks offer fixed or floating rate of interests on these loans, and the rate ranges from 12% to 16%, that is lower than the personal loan interest rate. Only one kind of loan is more expensive than that of loan against property, and that would be a home loan.

Getting this type of loan is advisable because, firstly the loan tenure is more than that of personal loans that has a loan period of a maximum of 5 years. Secondly, if you wish to prepay the loan the banks though would not levy any kind of charges for loans given on floating rate of interest, but a 2% to 4% penalty is charged on loans given on fixed rate of interest.

Ways to get a loan against property

The property that is being put as collateral is singly held it will be accepted easily but if it held by multiple people, then all the holders have to apply together to avail a loan against that asset. Any kind of asset would work, from a shop to piece of land anything would do.

Verification of all the documents that is related to the property will be done by the bank itself of by any government agency. Copies of documents such as identity proof which includes your voter ID card, PAN card, aadhaar card or your passport electricity bill, your ration card, ownership papers of the property. For salaried employees six months bank statement has to be provided, but if the person is self-employed then a bank attested copy of two years has to be submitted.

The amount of loan that is given by the banks may vary from one person to another, as it depends on a lot of factors such as a person’s work profile, age, experience, the company he is working with, etc. A person has to have a proof of income for at least 3 years before applying for a loan. Therefore the minimum age of an applicant would be around 24-25 years. The repayment tenure is set as per the age of the person, as the bank would want the amount to be recovered while the person is still employed, because of which the salaried employees can get a loan tenure of up to attaining 60 years of age, and in the case of self-employed people the repayment limit is up to 65 years.

Your credit history and score will also be checked by the bank before giving you the loan. The Credit Information Bureau India Ltd. also known as CIBIL keeps a record of a person’s credit history. The loan amount can increase or decrease based on your credit score.

Should you consider getting a loan against your property?

A major reason why people do not keep their houses as collateral with the bank is that, in case there is a situation where you cannot repay the loan there is a fear of bank ceasing your house to recover the money. There are no tax benefits in taking a loan against property, unlike home loans. The main reason people usually don't opt to mortgage their house is that they don't want to take the risk of the bank taking over the property if they are unable to pay the dues. This condition applies on a salaried person only and not on a businessman, who can avail deduction on the amount of interest paid on the loan.

If a businessman opts for a loan against his shares or securities or gold then also he can claim a tax benefit.

Interest Rates:

For securities: 12% to 15% for up to 60% of the current value of these securities.

Gold : 14% to 25% for up to 70% of the value of gold.

If incase the person is unable to repay the loan amount, the bank would liquidate the securities or gold to recover the money.

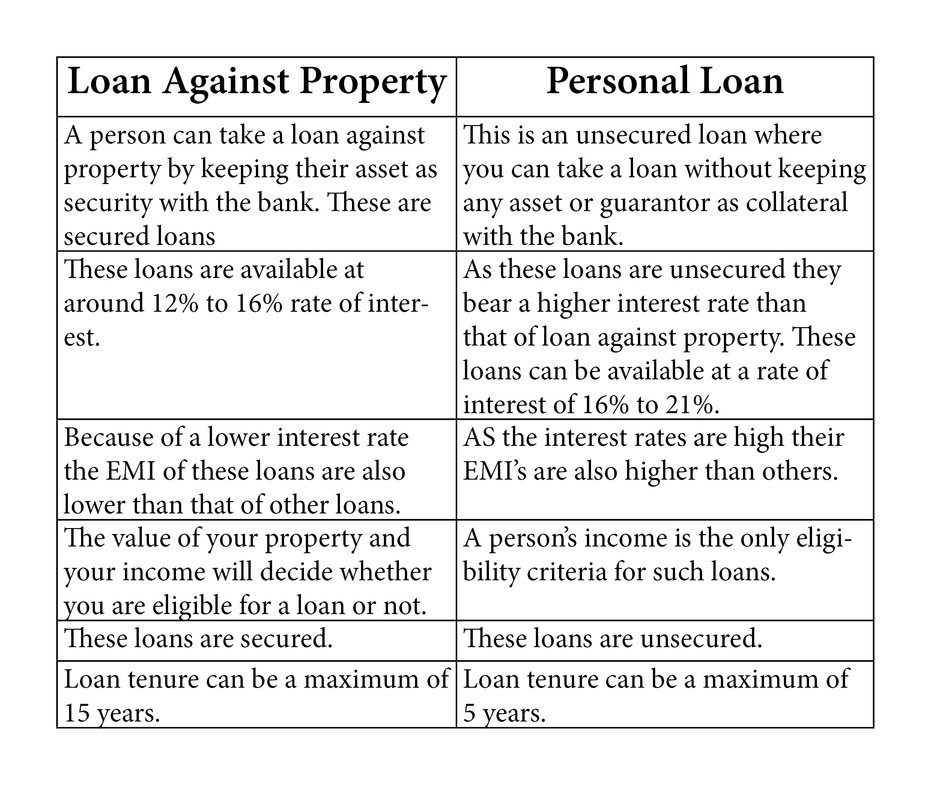

Loan Against Property V/S A Personal Loan

To get a loan against property you could consider keeping your home as collateral with the bank. Then the bank would send its assessing agents or take help from the agents provided by the government to assess the value of the house after which it may offer you’re a bank loan of up to 60% to 70% of the property’s current market price. Loan against property is a secured loan which will fetch you a higher amount on credit than that of a personal loan that if of course an unsecured loan. The administrative and the processing fee that is levied by the banks also have to be paid, which is generally 0.5% to 1.5% of the borrowing amount. Mostly the length of the loan tenure is up to 9 years, but a few banks might stretch it up to a maximum of 15 years. The banks offer fixed or floating rate of interests on these loans, and the rate ranges from 12% to 16%, that is lower than the personal loan interest rate. Only one kind of loan is more expensive than that of loan against property, and that would be a home loan.

Getting this type of loan is advisable because, firstly the loan tenure is more than that of personal loans that has a loan period of a maximum of 5 years. Secondly, if you wish to prepay the loan the banks though would not levy any kind of charges for loans given on floating rate of interest, but a 2% to 4% penalty is charged on loans given on fixed rate of interest.

Ways to get a loan against property

The property that is being put as collateral is singly held it will be accepted easily but if it held by multiple people, then all the holders have to apply together to avail a loan against that asset. Any kind of asset would work, from a shop to piece of land anything would do.

Verification of all the documents that is related to the property will be done by the bank itself of by any government agency. Copies of documents such as identity proof which includes your voter ID card, PAN card, aadhaar card or your passport electricity bill, your ration card, ownership papers of the property. For salaried employees six months bank statement has to be provided, but if the person is self-employed then a bank attested copy of two years has to be submitted.

The amount of loan that is given by the banks may vary from one person to another, as it depends on a lot of factors such as a person’s work profile, age, experience, the company he is working with, etc. A person has to have a proof of income for at least 3 years before applying for a loan. Therefore the minimum age of an applicant would be around 24-25 years. The repayment tenure is set as per the age of the person, as the bank would want the amount to be recovered while the person is still employed, because of which the salaried employees can get a loan tenure of up to attaining 60 years of age, and in the case of self-employed people the repayment limit is up to 65 years.

Your credit history and score will also be checked by the bank before giving you the loan. The Credit Information Bureau India Ltd. also known as CIBIL keeps a record of a person’s credit history. The loan amount can increase or decrease based on your credit score.

Should you consider getting a loan against your property?

A major reason why people do not keep their houses as collateral with the bank is that, in case there is a situation where you cannot repay the loan there is a fear of bank ceasing your house to recover the money. There are no tax benefits in taking a loan against property, unlike home loans. The main reason people usually don't opt to mortgage their house is that they don't want to take the risk of the bank taking over the property if they are unable to pay the dues. This condition applies on a salaried person only and not on a businessman, who can avail deduction on the amount of interest paid on the loan.

If a businessman opts for a loan against his shares or securities or gold then also he can claim a tax benefit.

Interest Rates:

For securities: 12% to 15% for up to 60% of the current value of these securities.

Gold : 14% to 25% for up to 70% of the value of gold.

If incase the person is unable to repay the loan amount, the bank would liquidate the securities or gold to recover the money.

Loan Against Property V/S A Personal Loan

This video talks about the impact of taking Loan against Property.

This video shows that Loan against property is more popular than Reverse Mortgage

RSS Feed

RSS Feed